With so many different types of checking accounts, you might find yourself overwhelmed by all those things to consider before making your final choice. Free checking accounts, interest-bearing checking accounts, as well as online checking accounts are probably the most popular types, since they come with benefits and services available to almost everyone. On the other hand, student checking accounts, senior checking accounts, and lifeline checking accounts are designed for students, senior citizens, and low-income consumers, respectively, but it doesn’t mean you should open one of these even if you do belong to a specific group. Such checking accounts might offer less benefits at a higher cost, which is something you should keep in mind.

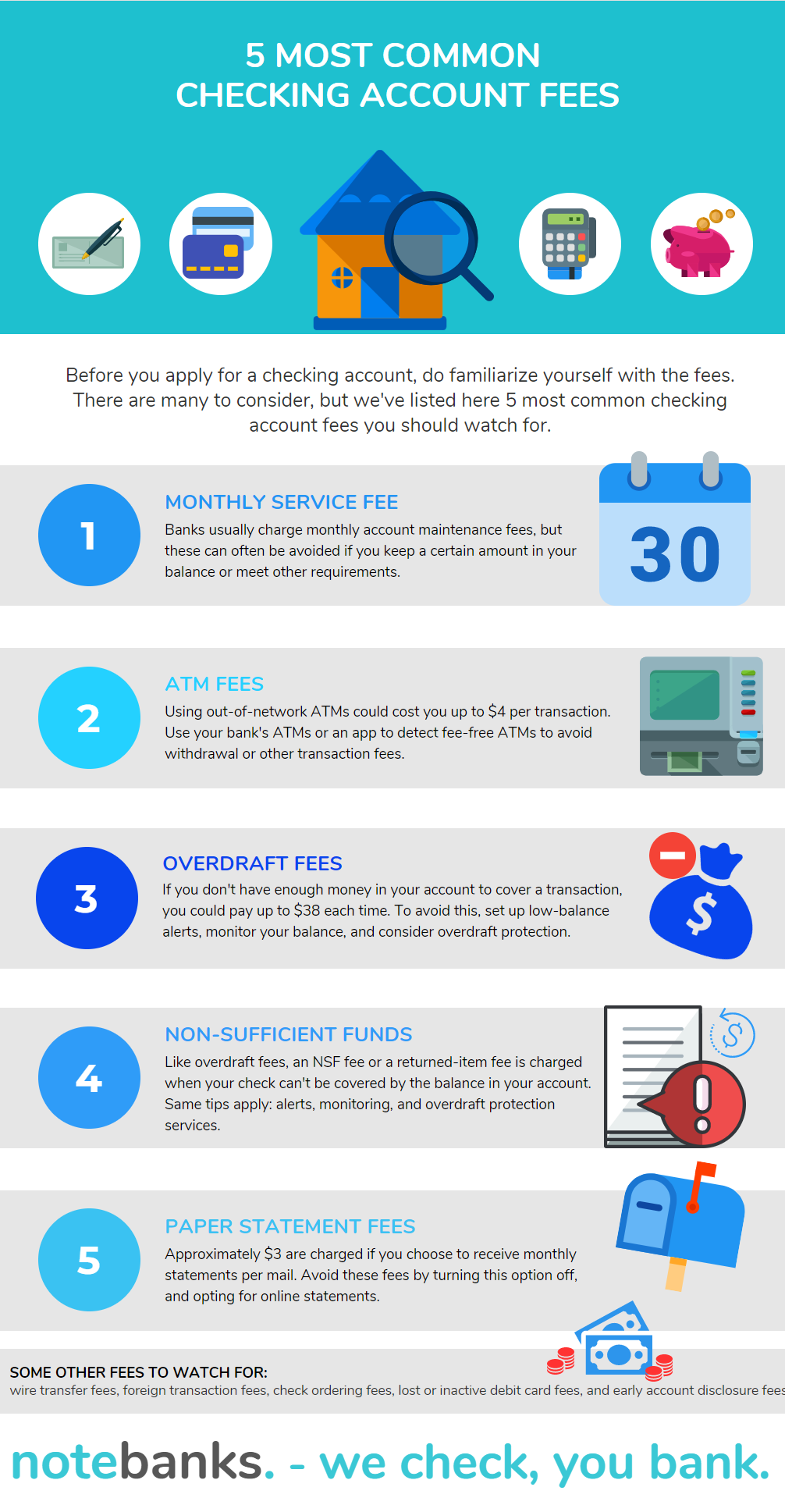

When choosing a checking account, some of the most important things to consider are the fees. Even though there exist many checking account fees, as we’ll see below, there are five most common ones you should check before applying for a checking account. We’ve explained them further down the page, and also included an infographic to help you get a better, instant overview of these fees.

5 Most Common Checking Account Fees

1. Monthly Service Fee

Monthly service fees are the fees you pay to maintain your checking account open each month. These fees vary anywhere between $0 and $50. Usually, the fee can be waived if you meet some conditions and requirements imposed by your financial institution. Whether you’ll need to keep an amount of money in your checking account balance each month or link a savings account to your checking account, it depends. However, you can easily avoid monthly maintenance fees without having to fulfill those conditions by simply opening a free checking account. Given how diverse checking account offers have become with the rise of neobanks, online-only banks offering great checking accounts with lots of benefits free of charge, you’ll have plenty of great checking account deals to choose from!

If you want to open a premium checking account, though, be ready to pay. For example, First Horizon’s TotalView Checking Account comes with a hefty $40 monthly fee, which you can have waived only “if you have 1 direct deposit or bill payment per statement cycle, keep a minimum $25,000 average daily balance across all of your First Horizon consumer checking accounts, AND if you keep a $100,000 average daily balance in consumer deposit and wealth accounts OR $50,000 or more in home equity and/or mortgage loan balances held in First Horizon’s portfolio OR $5,000 monthly debit card and/or credit card purchase transactions.” -> Complicated, right? That’s why it’s important that you check out as many available offers before signing the agreement!

2. ATM Fees

ATM fees are quite common and usually every checking account comes with out-of-network ATM fees, which are charged when you access your funds using an ATM that’s outside your bank’s network. ATM fees can go up to $5 per inquiry/withdrawal, but some banks offer ATM fee waivers on a number of ATM transactions each month. However, if your bank is part of a larger ATM network, such as Allpoint or MoneyPass, you’ll be able to use fee-free ATMs all across the country. If your bank has a mobile banking app, which most likely it does, you can use the app to detect fee-free ATMs wherever you are.

When traveling overseas, on the other hand, you should be more careful, as almost every bank will charge you for using your checking account debit card at foreign ATMs - in addition to foreign transaction fees of approximately 3% to 5% of the transaction. The best way to avoid these is simply to carry an international-friendly debit or credit card.

3. Overdraft Fees

Overdraft fees occur when you don’t have enough money in your checking account to cover a transaction. You can overdraw your account by using your card to make payments or ATM withdrawals, but also when you make online purchases or transfers. In case you don’t have enough money in your balance, such transactions will be declined, and your bank will charge you up to $38 per overdraft.

Overdraft fees don’t normally apply when you overdraw your account by less than $5, but, for other amounts, the fees can quickly add up. Some banks and financial institutions have set a limit to the number of overdrafts you can make per day - usually 4 to 6, but some can allow up to 12 overdrafts. Additionally, if you don’t fund your account quickly following the overdraft, you might also be charged “an extended overdraft fee”, which applies if you leave your account negative for a number of days.

You can always opt in for overdraft protection services to help you reduce overdraft fees, but these services are also payable, and not really required. If you really want to avoid overdraft fees altogether, then the smartest way to go would be to:

- Set up account alerts to keep track of your current balance and expenses.

- Set up payment reminders, so you’re always up to date with what’s to be paid, and thus ensure there’s enough money in your checking account balance.

- Have a savings account linked to your checking account, so, if you ever overdraw your account, the funds are automatically pulled from your savings to cover the transaction. In this scenario, pay attention to overdraft transfer service fees - most online banks don’t have them, though!

- Always keep an extra amount of money in your checking in case if.

- Familiarize yourself with your bank’s or financial institution’s fine print to ensure you fully understand which overdraft fees apply and when, but also whether you will receive any notifications before or following the unlucky occurrence.

4. Non-Sufficient Funds

Non-sufficient fund fees or NSF fees are considered to be the same as overdraft fees, and most banks treat them as such. However, there’s a small difference. Even though NSF fees are also charged when you don’t have enough money in your account, unlike with overdrafts, where your bank might cover the transaction if you opt in overdraft protection in particular, in NSF situations, your transaction will be declined. This especially applies to checks - hence they call those “bounced checks”. If your item/check is returned unpaid, you’ll be charged NSF fees, and not able to proceed with your desired transaction. Many merchants will also charge you a return-item/check fee on top of your bank’s NSF fees. What’s even worse is that your bank might try to process the check later during the day, which will result in your being charged multiple NSF fees for one single item.

So, it is crucial that you keep tabs on your balance at every moment, and don’t spend more than you’ve got available. The tips to avoid NSF fees are just like those we’ve mentioned above for overdrafts: set up balance alerts and notifications, monitor your account, and ensure you’ve got a steady stream of income deposited directly into your checking account every month, so you have to think less about funding it.

5. Paper Statement Fees

Paper statements fees are probably the most unnecessary checking account fees. Banks charge up to $5 for mailing paper statements to their customers each month. You can easily avoid these fees by going paperless, i.e. opting in for electronic statements through your bank’s online banking system. This way, not only will you reduce the cost of checking account maintenance, but you’ll also help save the environment. Plus, less paper means less clutter.

Other Checking Account Fees to Keep in Mind

In addition to the 5 most common types of checking account fees, there are many other fees that might not seem high, but can add up, so you should not oversee any of them.

1. Minimum Deposit to Open

Some financial institutions might ask you to make an initial deposit when opening a checking account. These amounts vary from one institution to another, and usually, higher minimum opening deposits are linked to more premium checking accounts in terms of benefits and services offered. So, for example, Bank of America requires customers looking to open an Advantage Plus Banking Checking Account to deposit $100, while BBVA’s Free Checking Account comes with a $25 minimum opening deposit requirement. Then we have the Bank of the West Premier Checking Account with an any-amount deposit required to open the account.

A thing to note here is that there is no way to avoid this “fee”, unless, in some instances, you’re a student or a senior citizen or even a military service member.

2. Foreign Transaction Fees

If you’re traveling outside the United States, you should get a debit or credit card you can use abroad at no extra cost because most banks charge foreign transaction fees. These can go up to 3% per transaction when you use your plastic overseas to make payments. You might also be charged a certain percentage by the card issuer, as well. Add to that up to $5 out-of-network ATM fees if accessing foreign ATMs to withdraw cash, and you can end up paying quite a lot!

3. Wire Transfer Fees

Wire transfers allow you to send money almost instantly to another person’s bank account. Yet, many banks will charge you extra for this service - anywhere between from $0 to $30, depending on whether it’s an outgoing domestic or international transfer. You might also be charged for receiving money (incoming transfers). The best way to avoid these fees is to use a free money transfer service provider or at least a cheaper alternative.

4. Check Fees

While checks aren’t as popular as they’re used to be, if you’re planning on using them, do note there might be additional fees applied. Some banks still offer unlimited check writing, while others limit the number of free checks on a monthly basis. You should also be careful when ordering checks as you might pay $20 or more per box, depending on your bank’s rates and check styles. Plus, some banks might not let you cash or deposit checks for free, so make sure to read the fine print to know what to expect.

If you’re planning a big purchase, and would like to pay with cashier’s checks (or bank checks), prepare to pay approximately $10 per check. And if you ever request copies of your paid checks, there might be fees, too.

The best way, overall, to avoid check fees is not to use checks at all. Make payments electronically or check to see whether there are less expensive options or fee waivers offered by your institution or a verified third-party service provider, such as Checks In The Mail or Carousel Checks.

5. Card Replacement Fees

If you request a new ATM or debit card prior to its expiry date, you’ll have to pay a card replacement fee of approximately $5 or more, if you need rush delivery. In case of a lost or stolen card, there’s no way to avoid this fee, although if you have another debit card you can use while waiting for the new one to arrive, you can at least save on shipping!

6. Inactivity and Account Closure Fees

If you keep your account open, but inactive for a certain period of time, you might incur an inactivity or dormant account fee, typically between $5 to $20 per month. To avoid this, simply make transactions, and log in to your account regularly.

On the other hand, if you decide to close your account, wait at least 90 - 180 days before doing that in order to avoid potential early account closure fees (up to $25).

7. Customer Service

Some banks will charge you when you ask them to do some [urgent] banking tasks for you. These might be stop payment orders (up to $50), check copy orders, legal processing orders, etc. Additionally, some phone banking services might also not be free, but less expensive than if you requested human help. Unless you really need personal assistance, you can use online banking for almost all your needs free of charge.

Bottom Line

Now that you’ve learned more about checking account fees, you should be able to better compare available checking account offers. Since there are many, try to narrow them down, per type, features or bank’s location, for example. This way, you will find an offer that’s most suitable to your needs, while reducing the cost of checking account maintenance!

Finally, here's the promised infographic for an easier overview of all these fees!